Some Of Steve Young Realtor

Table of ContentsThe Main Principles Of Steve Young Realtor An Unbiased View of Steve Young RealtorThe Ultimate Guide To Steve Young RealtorThe 3-Minute Rule for Steve Young RealtorLittle Known Facts About Steve Young Realtor.

Actual estate is generally a fantastic financial investment alternative. That's not to point out the ongoing maintenance costs you'll be liable for, as well as the potential for earnings spaces if you are in between lessees for a time. Here's what you need to know regarding investing in real estate and if it's the best option for you.If you can not pay for to pay cash money for the home, at the really the very least, you should have the ability to pay for the home loan payments, also without rental earnings. (Use our calculator listed below to assist you decide.) Consider it: With occupants, there can be high turn over. You might also experience a time where you have no renters in all for the building.

The 10-Second Trick For Steve Young Realtor

And also, if you can't pay the home mortgage, it could wind up destructive your credit rating, which will cost you cash in the future. Strategy Out All of Your Costs When purchasing real estate for investment purposes, you require to think about the expense of tax obligations, utilities, maintenance, and repairs. Commonly, it is easier to experience a rental company and also have them handle things like fixings and rent out collection (steve young realtor).

Especially if you don't have time to do everything that needs to be done at your building, utilizing a firm is a great option. You need to value your rental property to ensure that every one of these charges as well as various other expenditures are completely covered. steve young realtor. In addition, you should take the first couple of months of excess cash as well as established it apart to cover the cost of repair services on the building.

You need to likewise be prepared to take care of added costs as well as various other scenarios as they develop, maybe with a sinking fund for the residential or commercial property. Study the Building Thoroughly If you are buying land that you plan to cost a later date, you require to investigate the land deed extensively.

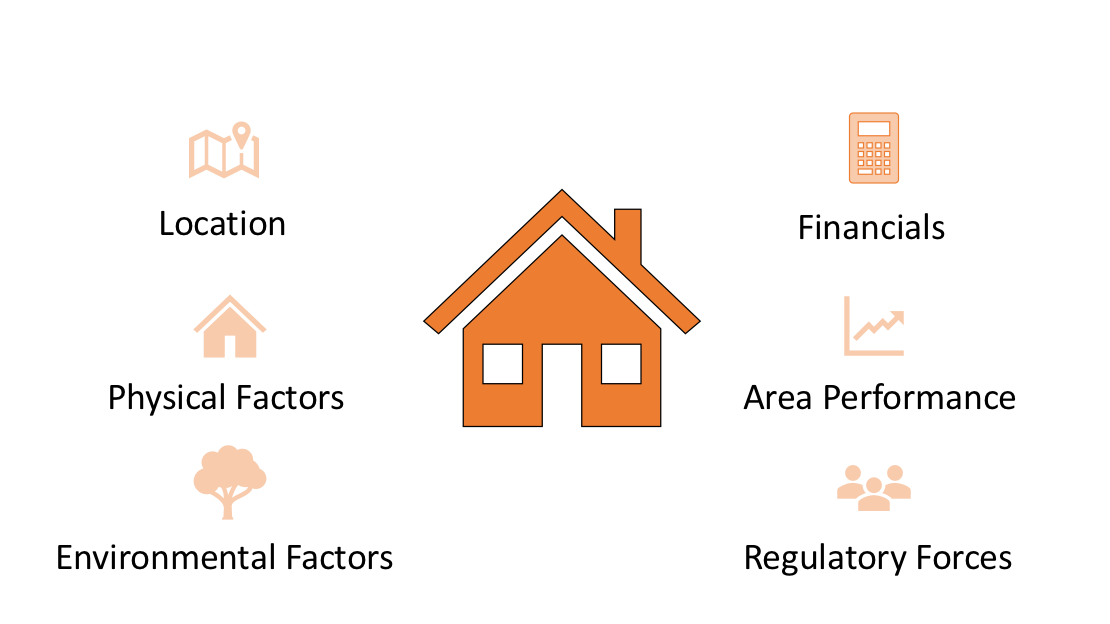

Likewise make certain there isn't a lien on the home. You may likewise want to take into consideration points like the comparables in your area, including whether the location is up-and-coming, as well as various other exterior factors that can impact the residential property worth. When you have actually done your study, you ought to have the ability to make the right decision about purchasing it as an investment.

The Best Guide To Steve Young Realtor

You might make cash on your investment, but you can lose cash. Points might alter, and also an area that you believed may boost in worth might not really go up, and also vice versa. Beginning Small Some genuine estate investors start by purchasing a duplex or a house with a cellar apartment, then living in one device and also leasing the other.

Property wholesaling may also be one way to begin buying property without a great deal of up-front resources. In addition, when you established your budget plan, you will intend to make sure you can Learn More cover the entire month-to-month home loan repayment and still live comfortably without the additional rent payments being available in.

Just how do you spend in genuine estate? You can take several routes to obtain started in actual estate. One would certainly be to acquire a multi-unit residential property as well as lease out the various other devices.

You can additionally lease areas in your very own house to develop the funds to purchase even more realty. REITs additionally permit you to purchase realty, however without having to save up the cash money to get a property or keep one.

Fascination About Steve Young Realtor

The trick is to do your research to figure out which sort of real estate investing is the very best fit. REITs Purchasing right into REITs, short genuine estate investment trust funds, is one of the simplest methods to purchase property. Why? With a REIT, you spend in genuine estate without having to fret about maintaining or managing any physical structures.

When you buy right into a REIT, you buy a share of these residential properties. It's about his a bit like purchasing a mutual fund, only as opposed to supplies, a REIT deals with realty. You can generate income from a REIT in two means: First, REITs make normal reward payments to capitalists.

You can invest in a REIT simply as you would certainly invest in a stock: REITs are noted on the significant supply exchanges. The National Association of Real Estate Investment Trusts says that regarding 145 million U.S. homeowners are invested in REITs.

Facts About Steve Young Realtor Revealed

You can then either reside in the building or rent it out as you wait on it to appreciate in worth. If you rent the residential property, you may be able to utilize these click here now monthly checks to cover all or component of your monthly mortgage settlement. Once the home has appreciated enough in value, you can offer it for a big payday.

You can reduce the chances of a bad financial investment by researching neighborhood communities to find those in which house values often tend to increase. You need to likewise deal with real estate representatives and also various other experts who can you show historical recognition numbers for the areas you are targeting. You will have to bear in mind area.